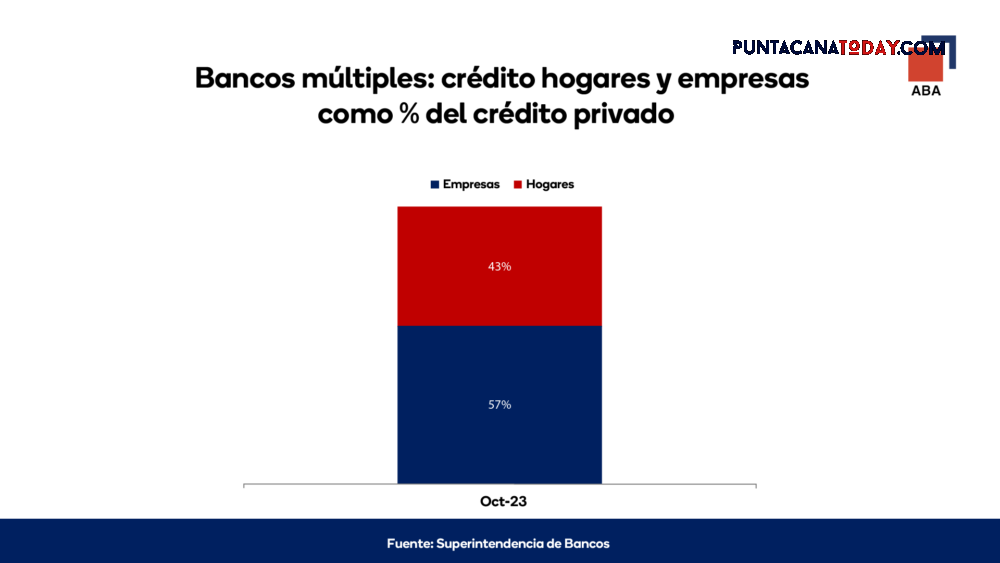

Santo Domingo, Dom. Rep. – The credit granted by multiple banks to the private sector is distributed in a balanced manner between companies and households, which concentrate 57% and 43% of that portfolio, respectively, revealed the Association of Multiple Banks of the Dominican Republic (ABA).

The ABA explained that, as of October 2023, some 85 thousand mortgage loans had been disbursed, involving a total of RD$220 billion allocated to the construction and renovation of housing units throughout the country. He expressed his confidence that this trend will continue, based on the incentives offered by the State in coordination with the private sector.

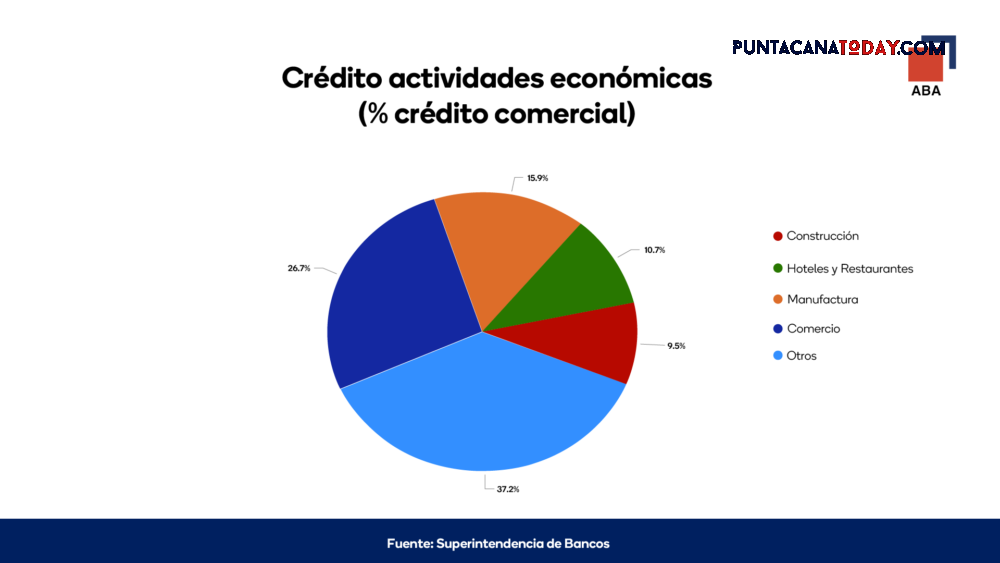

In a press document, the banking association also referred to the financing granted to companies, especially aimed at areas that drive the country’s economic growth, including commerce, manufacturing, tourism and construction, sectors that account for 60% of this type of credit, he pointed out.

Likewise, he expressed that banks have been incorporating MSMEs into their business model in recent years, which has allowed these companies to gain participation, representing 40% of the balance of the commercial portfolio as of October.

Regarding the export sector, the entity that brings together the country’s multiple banks reported that credit in this area increased more than RD$27 billion between 2014 and 2023, which implied important support for the development of this foreign currency-generating sector. , which includes small, medium and large companies, with national capital and free zones.

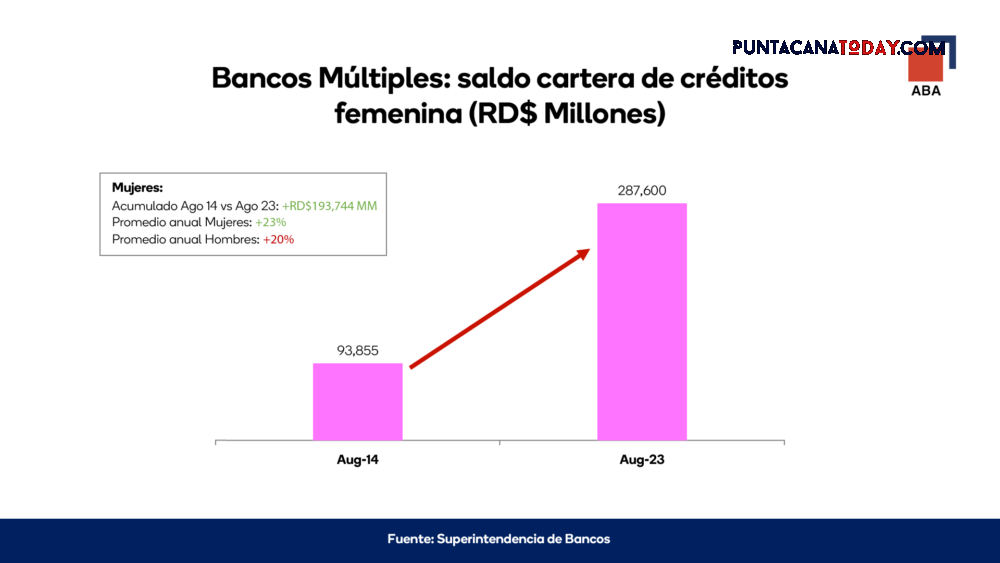

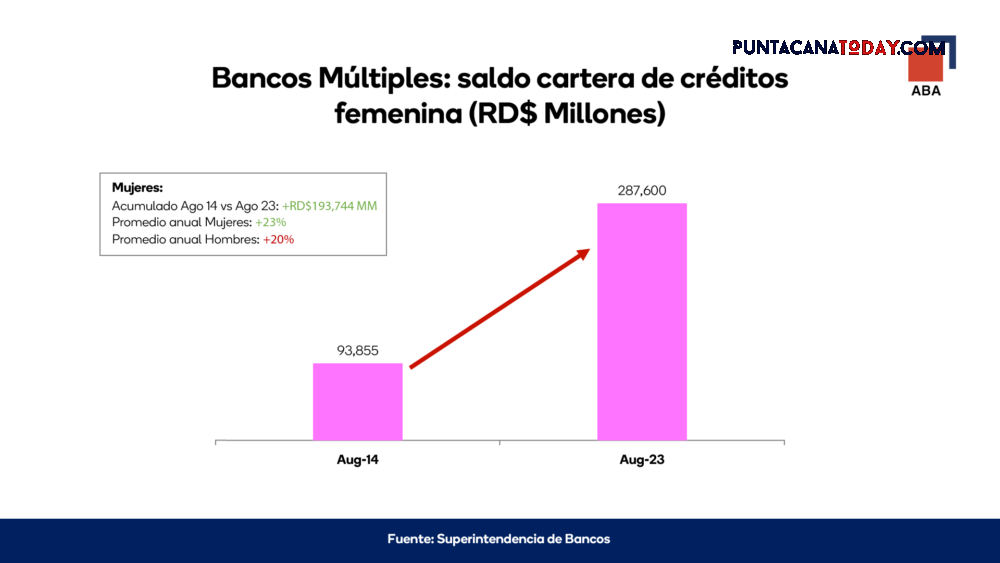

He expressed that another relevant segment has been financing for women, which totals 2.3 million loans, which they use mostly at home or in the development of businesses. In this sense, he specified that the balance of the female credit portfolio stood at RD$283,600 million as of August 2023, which represents an increase of RD$193,744 million compared to 2014 and a growth 17% faster than that of male credit. .

Regarding green credit, an item that contributes to the transition of Dominican companies towards environmentally sustainable practices, the union reported that between 2017 and 2022 it increased more than RD$12 billion in its balance, growing 541% faster than the commercial portfolio. .

Finally, the ABA ratified the interest of multiple banks in continuing to support the productive sectors and households through financing, while serving as an efficient channel for transmitting the monetary policy of the authorities in an attempt to reduce the price of money. and boost the economy for the benefit of the national community.