Santo Domingo, RD.- Since the pandemic period, the Dominican multiple banks have redoubled their efforts to support the growth of micro, small and medium-sized businesses through financing this productive sector, said the Association of Multiple Banks of the Republic. Dominican (ABA).

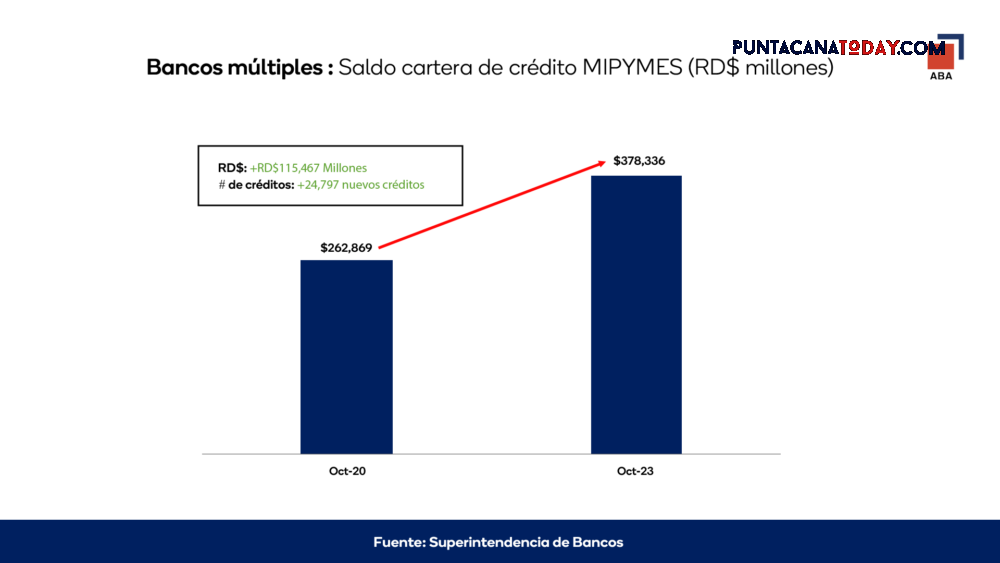

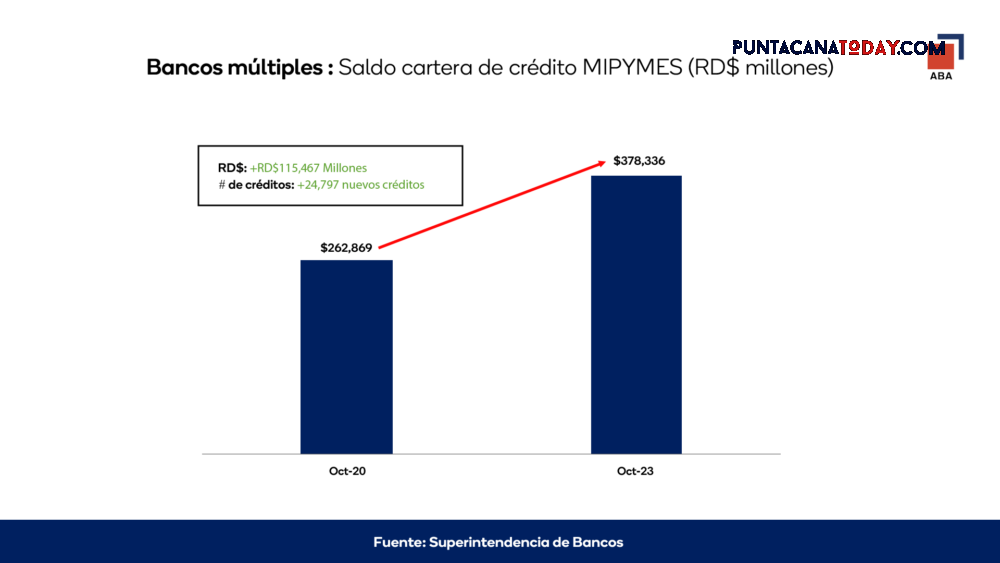

In this sense, the ABA reported that commercial banking credit to MSMEs went from RD$262,869 million in October 2020 to RD$378,336 million in October 2023, which implies a cumulative growth of 44% in relative terms and RD$115,467 millions in absolute values.

The increase registered in this portfolio is equivalent to an average annual rate of 12.9%, detailed the banking union, specifying that during the last three years, multiple banks disbursed RD$38,489 million annually to MSMEs, on average.

Regarding the number of loans granted to MSMEs, the total went from 132,777 financings in October 2020 to 157,574 in October 2023, for a cumulative increase of 24,797 loans (19%), which in annual terms is equivalent to an annual increase of 8,266 new credits per year, the ABA stated.

The banking union indicated that these results have been possible thanks to the monetary stimuli provided by the Central Bank through different means, since 2020, and that have been channeled by commercial banks towards the productive sectors.

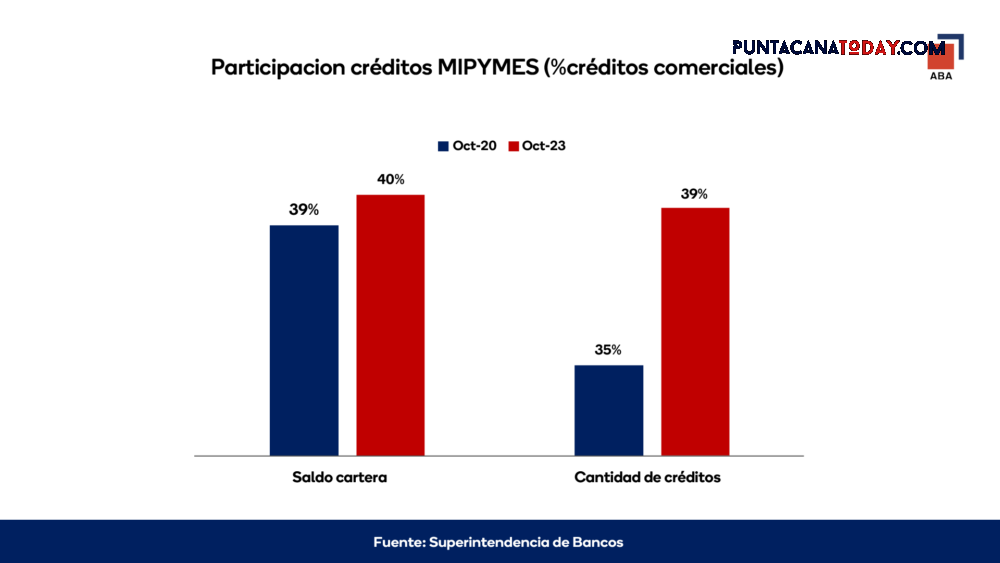

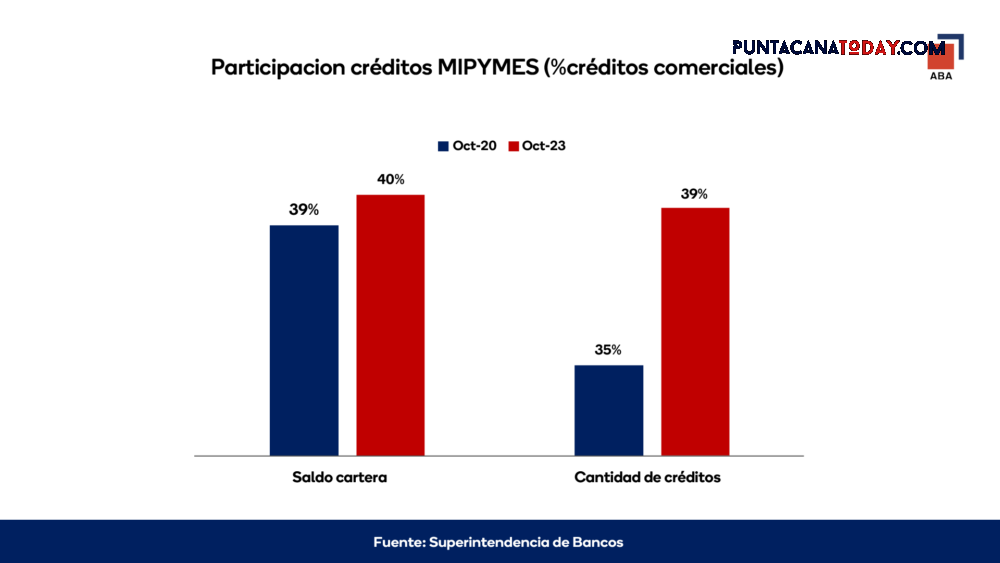

He expressed that, taking into account this dynamic observed in the last three years, the participation of the balance of the MSME credit portfolio in the total commercial portfolio represents 40% as of October 2023. Likewise, he indicated that the participation in the number of MSME loans increased from 35% in October 2020 to 39% in October 2023.

The ABA noted that “the figures show that bank credit aimed at MSMEs has been a key instrument for the viability and expansion of small and medium-sized businesses, especially given the difficult situation generated by the pandemic since 2020.”

“There is still a way to go and, for this reason, the Dominican banking sector will continue working on initiatives aimed at promoting MSMEs’ access to credit under increasingly favorable conditions, including guarantee funds, alternative risk assessment mechanisms, legal instruments of factoring and/or leasing, among others,” stated the Association of Banks.

He explained that these projects are carried out in coordination with public, private and international organizations, with the purpose of serving an increasingly greater number of companies and thus contributing to the generation of employment and investment and, consequently, to the well-being of Dominican society. .