Santo Domingo, RD.- In recent years, commercial banks have shown signs of their growing commitment to the environment, which is reflected in the evolution of “green” credit and the promotion of digital green finance, through various initiatives that combine technology and sustainability, said the Association of Multiple Banks of the Dominican Republic (ABA).

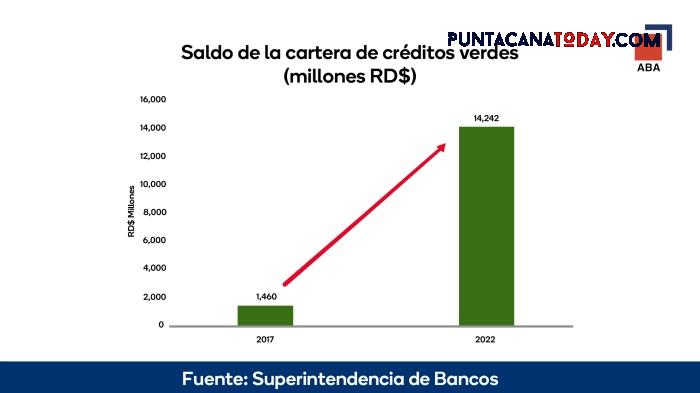

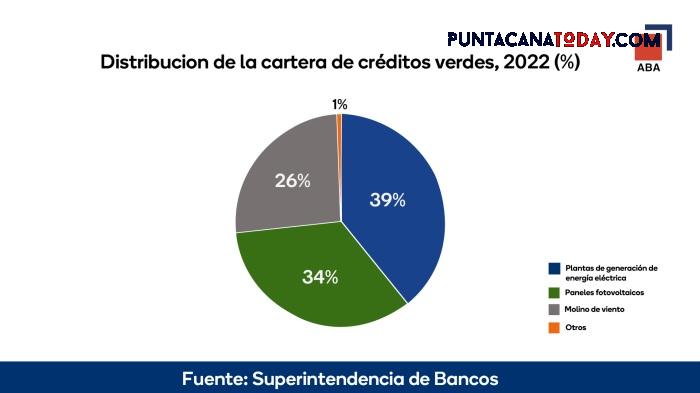

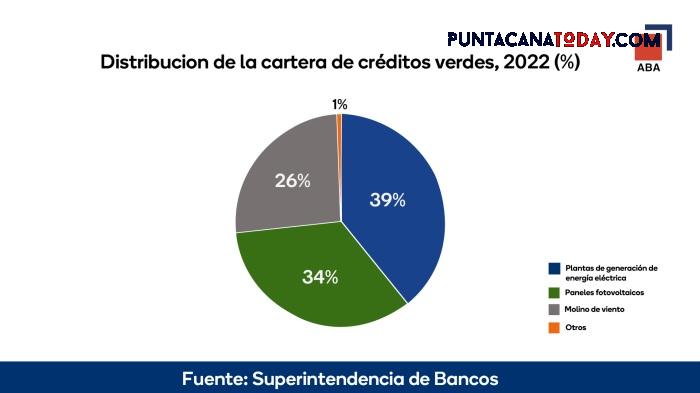

In that sense, the aba reported that green credit destined for companies, between 2017 and 2022, exhibited a growth of more than RD$12 billion, equivalent to an average annual growth of 59.6%, an increase that exceeded the average growth of credits by more than six times. commercials, which was 9.2% annually. He highlighted that these credits have been mainly focused on financing “clean” or renewable energy sources such as electricity generation plants (39%), photovoltaic panels (34), windmills (26%) and others (1%).

In a press document, the ABA recalled that digital green finance involves the promotion of financial products and services that incorporate environmental aspects in credit allocation decisions and in their risk management practices, promoting responsible investments and stimulating technologies and projects with low carbon emissions.

He explained that the banking sector encourages the use of technologies such as the Internet of Things (IOT), big data, artificial intelligence (AI), among others, in the management of financial entities. He explained that these technologies, in addition to having the potential to expand financial inclusion, reduce costs and improve efficiency in the provision of services, are also capable of reducing the environmental impact of the financial industry.

Digital green finance: the future of banking is today

Although the term Digital Green Finance is relatively new for the banking sector, the ABA explained that it is leading the promotion of three high-impact projects that combine sustainability and technologies, together with its partners and other entities, which are: Green Protocol, Digital Signature, and Digital Onboarding.

He explained that the Green Protocol, led by the ABA Sustainability Committee, with the support of the World Bank Group, represents a historic effort by the entire Dominican banking sector for the voluntary adoption of best practices and standards in matters of sustainability.

Also, the ABA indicated that they seek to exponentially increase financial inclusion in the country, framed in the strategy led by the Central Bank in this regard, with the implementation of the Digital Signature. Digital signing involves the remote and digital authentication of documents and transactions using electronic signatures, and Digital Onboarding, which refers to the process of registering and verifying clients in a completely digital way. He indicated that these will contribute to the adoption of more sustainable practices in our societies, for example, through the streamlining and simplification of processes, reducing the carbon footprint associated with the generation of paper and the transportation of documents.

The banking association maintained that with these initiatives, the Dominican bank wants to contribute to the adoption of sustainable practices and advanced digital technologies, seeking to be a reference in the promotion of green banking in the region, and contribute to the construction of a brighter future, sustainable and responsible, where technology and banking work together to address promoting sustainable economic development in the Dominican Republic.