Rewrite this content and keep HTML tags, correct grammar, do not rewrite words starting with capital letters, separate the sections of text longer than 20 words

- Assets exceed 215,668 million pesos and net profits exceed RD$27,566 million, at the end of last December

- Financing for tourism totals more than US$1,188 million during the last four years

- Loans to the sector amount to RD$54,294 million, for an exceptional growth of 144%

Madrid, Spain. – The executive president of the Reserve Bank, Samuel Pereyra, reported that Banreservas' assets rose to one trillion 215 thousand 668 million pesos, at the end of 2024, while net profits amounted to RD$27,566 million, for an increase of 12.5 %, compared to those obtained the previous year, in obviously historic and unprecedented results for the management of the Banco de Todos los Dominicanos, founded on October 25, 1941.

The increase in assets was RD$ 88,061.9 million more than in December 2023, for a growth of 7.8% compared to that period, a milestone that no bank in our financial system has reached, achieving the highest indicator in our history. This represents 37.3% of the entire commercial banking market.declared Pereyra.

He affirmed that the commitment of that institution to the development of tourism in the Dominican Republic has been constant in the last four years, supporting investments that exceed USD$1,188 million, contributing significantly to the creation of more than 16,000 direct and indirect jobs.

Tourism financing

Pereyra revealed that the tourism credit portfolio registered, at the end of December 2024, an exceptional growth of 144%. “Our portfolio, which at a general level in 2020 contemplated an amount of RD$22,261 million, at the end of December 2024 presents an amount of RD$54,294 million.”

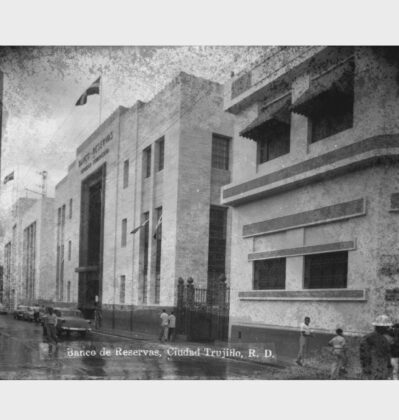

First official branch of the Reserve Bank-.

He highlighted that the participation of that entity's credit portfolio within the Multiple Banking system went from 29%, in 2020, to more than 44%, at the end of 2024, as a result of the financing granted to the hotel sector. “To which is added our absolute leadership in financing tourist ports and theme parks.”

He specified that the investments financed in tourism by Banreservas have provided 3,121 rooms, in 11 hotels, two cruise ports, and an internationally recognized theme park, in addition to facilities for working capital and remodeling of hotel structures.

The banking executive offered the details during a meeting with Dominican journalists to kick off Banreservas' program of activities in the 45th edition of the Fitur 2025 International Tourism Fair, which is being held in this capital, from the 22nd to the 26th of this month.

“In the last 4 years we have supported projects that have helped strengthen and expand the entire value chain of the tourism sector, promoting innovation and growth in destinations such as Miches, Pedernales, Montecristi, La Romana, Punta Cana, Santo Domingo, and Puerto Plata granting financing that exceeds 531 million dollars,” said Pereyra.

94% of the credit portfolio is private

Banreservas' gross loan portfolio closed with RD$576,460 million in 2024, RD$61,867 million higher than in 2023. The funds destined to finance the private sector totaled RD$540,641 million, equivalent to 94% of the total portfolio, he explained.

The Bank's total deposits, at the end of December 2024, stood at RD$929,350 million, for an increase of RD$59,772 million, compared to the same period in 2023, equivalent to 6.9%, “which reflects the confidence of clients in the institution and the success in the implementation of acquisition strategies by our formidable business team, making us leaders in deposits in the national multiple banking system,” he stressed. Pereyra. Of that amount, deposits corresponding to the private sector totaled RD$752,088 million, equivalent to 81% of the portfolio.

“The Reserve Bank – he said – has played a key role in the social and economic development of the Dominican Republic, supporting fundamental initiatives such as the construction of low-cost housing and the strengthening of remittances.”

He expressed that, through accessible programs and financing, Banreservas has provided thousands of families with access to a decent home, contributing to improving their quality of life. While its support for remittances has allowed it to optimize the receipt of these essential resources for millions of Dominicans, consolidating its commitment to the well-being of the communities and the sustainable progress of the country.

Pereyra indicated that throughout the week Banreservas will be developing an intense business agenda at FITUR to promote tourism investment in the Dominican Republic, a fair that he said represents “a strategic bridge between economic development and tourism, a key sector for our nation.”